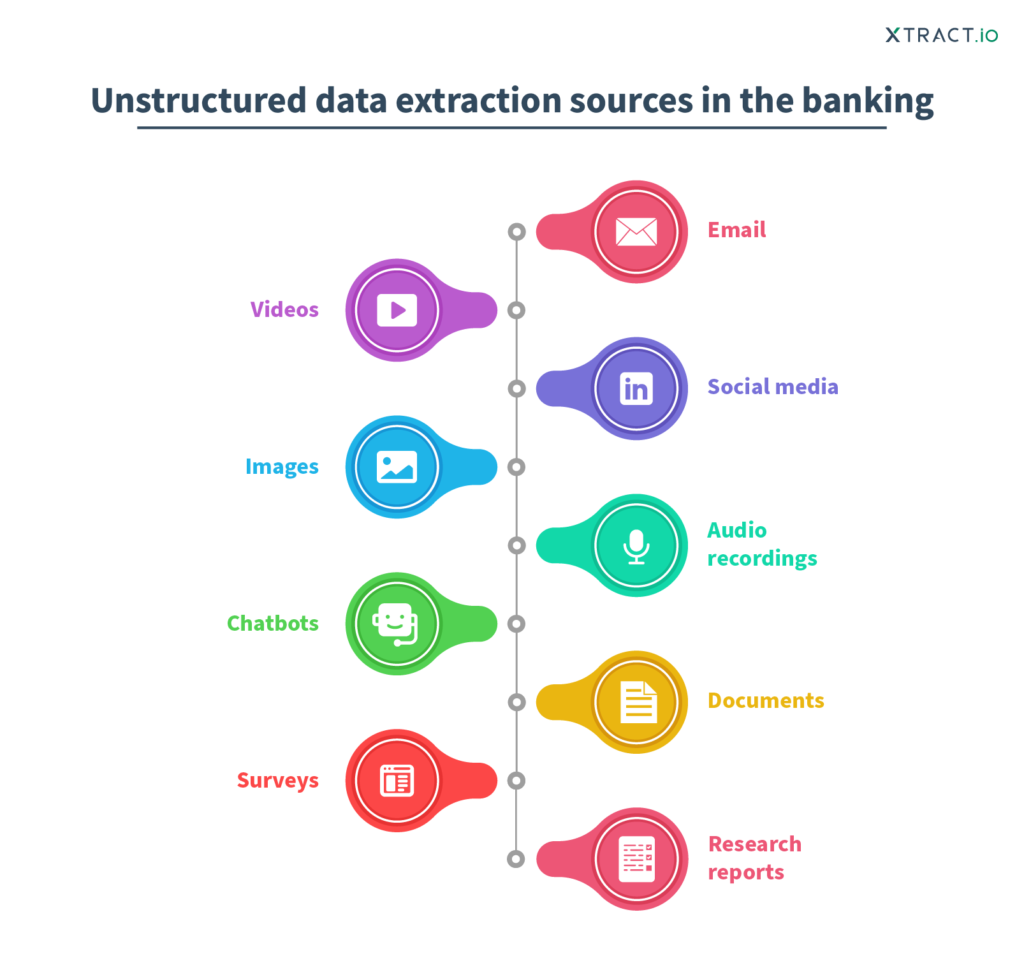

In the ever-evolving banking world, data has become a priceless asset, and its proper utilization can make or break an institution’s success. The sheer volume of unstructured data, encompassing emails, social media interactions, audio recordings, documents, and more, presents a unique challenge and an untapped opportunity for financial institutions. The role of unstructured data extraction in the banking sector has grown exponentially in recent years, offering a new dimension of insights and possibilities.

Leveraging advanced and powerful unstructured data extraction solutions can decipher the invaluable knowledge concealed within unstructured data. This extraction process not only empowers institutions with a comprehensive understanding of their customers but also drives innovation, compliance, and risk management to propel the industry forward.

The chaos of unstructured data extraction in banking

One of the primary hurdles of unstructured data extraction is its sheer volume and diversity. It is reported that almost 80% of a bank’s data is unstructured, and traditional data management systems struggle to cope with this deluge. Unstructured data encompasses vast information, ranging from customer interactions, emails, and social media posts to scanned documents, images, and audio recordings. Extracting meaningful information from this massive dataset becomes a daunting task, hindering the efficient utilization of this invaluable resource.

The unstructured nature of the data makes it challenging to organize, process, and extract valuable insights, creating chaos for financial institutions. Manual efforts to sort through unstructured data are time-consuming, error-prone, and impractical, especially when dealing with large-scale datasets. This chaos can lead to missed opportunities, delayed decision-making, and an incomplete understanding of customer behavior and market trends.

Embracing automated unstructured data extraction solutions can help banks gain a competitive edge, ensuring that relevant information is efficiently captured and organized.

Role of unstructured data extraction in banking

Banks have experienced transformative impacts in various operations by effectively harnessing the potential of unstructured data. Here are some key areas where unstructured data extraction solution has made a significant difference:

Precise customer insights

Banks can tailor their products and services to meet individual needs by analyzing unstructured data from social media, customer feedback, and call center interactions. This allows for improved customer satisfaction and loyalty.

Also, it helps banks to identify patterns and trends, enabling the creation of highly personalized and targeted offerings. UDE cultivates a sense of relevance and value for customers by aligning products and services with individual preferences, resulting in heightened satisfaction and increased loyalty.

Improved risk management

Unstructured data extraction solution empowers banks with a comprehensive understanding of potential risks and uncertainties that can impact their operations. Unstructured data sources, such as financial news, industry reports, and regulatory updates, offer valuable insights into market trends, macroeconomic indicators, and emerging risks. By extracting and analyzing this data, banks can proactively assess market shifts, identify potential threats, and anticipate challenges before they materialize.

Banks can develop early warning systems to monitor risk indicators and trigger appropriate responses by carefully analyzing the unstructured data. It also helps banks to ensure adherence to industry standards and mitigate compliance risks. Additionally, UDE enables banks to track emerging risks in real-time, allowing for agile decision-making and timely risk mitigation strategies.

Real-time market intelligence

Extracting insights from unstructured data sources enables banks to respond swiftly to market shifts, identify investment opportunities, and optimize their strategies for better financial outcomes.

They can swiftly adjust their investment portfolios, seize favorable market conditions, and navigate through potential risks. Unstructured data extraction solution allows banks to track competitors’ activities, identify potential disruptors, and make proactive moves to safeguard their market position. With access to up-to-the-minute market intelligence, banks can avoid making decisions based on outdated or incomplete information, leading to more accurate and profitable choices.

Streamlined compliance and reporting

Compliance with regulatory requirements is critical to the banking sector. Robust unstructured data extraction solutions simplify compliance efforts by automating the extraction of relevant information from complex regulatory documents and legal contracts, reducing the risk of errors and ensuring adherence to industry standards.

Furthermore, an automated unstructured data extraction solution facilitates the integration of unstructured data with structured data from internal systems, creating a comprehensive view of the bank’s compliance posture. This seamless integration enables compliance officers and management to understand the institution’s compliance status better, identify potential gaps, and implement timely remediation measures.

Innovation and product development

Banks can develop innovative financial products and services that cater to evolving customer needs by identifying customer pain points and market gaps. UDE allows banks to identify niche markets and unexplored opportunities that traditional data sources may not capture. Banks can identify gaps in existing product offerings and conceptualize new, innovative solutions.

Moreover, the agile nature of UDE allows banks to adapt and iterate their products and services quickly. Banks can fine-tune their offerings to remain relevant in a dynamic and competitive landscape by continuously monitoring customer sentiment and market dynamics. This responsiveness to customer needs and market trends enhances customer satisfaction and positions banks as forward-thinking and customer-centric institutions.

Leverage the transformative power of unstructured data extraction solution

In the dynamic and data-driven banking landscape, unstructured data extraction solutions have become financial institutions’ game-changers. As this blog explored, leveraging the power of unstructured data can unlock a wealth of opportunities and insights that traditional data sources cannot provide. From understanding customer preferences and sentiments to proactively managing risks and complying with regulatory standards, unstructured data extraction revolutionizes banks’ operations.

If you are looking to harness the untapped potential of unstructured data in your banking operation, look no further! With Xtract’s cutting-edge unstructured data extraction solution, banks can leverage the full potential of unstructured data. Get a free demo today and drive your institution toward a future of innovation and excellence.