The financial sector is a complex and ever-changing industry that plays a critical role in the global economy. But, for a financial industry to comply, innovate, or expand, the analysts must be able to access every piece of information available about the customer, market, competitor, and much more. Due to digitization, financial institutions have become inundated with data. Manually extracting all the information is a tedious task. Before the analyst can extract the data manually, the market trend will suffice. So, most financial sectors have begun to use robust data extraction solutions to gather information instantly.

Data extraction solutions can extract information from any third-party source, helping institutions make informed decisions. In investment banking, data extraction could be used to extract information about the market condition, various investment options available, and the potential of those investments. Without this information, organizations have to make deductions based on assumptions, jeopardizing their stake. The right data extraction solution can help to improve the values of financial sectors all over the world.

Why do financial institutions need data extraction tools?

According to Epsilon research, 80% of customers are more willing to do business with organizations offering a personalized experience. Customers want a hyper-personalized experience instead of a generic one. So, if you are wondering what this hyper-personalization is, it is about providing a tailored experience based on customer interest and choices. Here is when the data extraction comes into the picture. For example, information on the type of product used, income, and demography can assist financial sectors in learning more about the customer and providing unique product recommendations, promotional offers, and financial management.

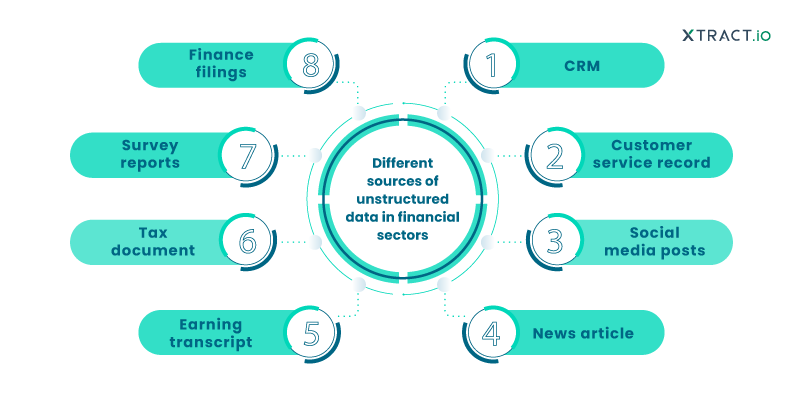

A massive amount of unstructured data is one of the financial sector’s significant challenges. According to a Forbes article, 90% of organizational information is unstructured, growing at the rate of 55-65%. Unstructured data is often overlooked in organizations because it is difficult to extract and is not organized in a pre-defined format.

Customer feedback can provide valuable insights into their preferences and needs, allowing financial institutions to improve their products and services. Unstructured data from social media posts and news articles, on the other hand, can provide valuable information about market trends and sentiment, allowing institutions to make more informed investment decisions. A robust data extraction solution can assist organizations in extracting such valuable information using various powerful data extraction techniques such as API calls, database querying, and web mining.

How can the deployment of data extraction solutions help financial services?

Deploying data extraction tools can benefit financial services organizations in various ways, including saving time, reducing human error, increasing data accuracy and reliability, analyzing customer purchasing patterns, and identifying opportunities for cross-selling or upselling.

Here are some of the most critical use cases of data extraction in the financial sector.

Instant fraud detection

Mitigating fraudulent activities and improving risk management is challenging in the financial sector. A McKinsey report estimated that total fraud accounts for 5% of global corporate revenue. In financial institutions, there are a lot of fraudulent activities such as identity theft, advance fee fraud, credit application fraud, etc. If any of these activities happen in a particular bank or an insurance company, customers would want to avoid dealing with that institution again. Here is when data extraction comes into the picture.

Data extraction solutions can help gather information about the customer spending pattern, the type of products they purchase, etc., to develop a model and flag any suspicious activity. This way, banks can prevent any theft. Also, extracting information about the customer’s credibility can help bank executives when offering new credit cards, extending credit limits, or offering a loan.

Enhanced customer relationship

In today’s competitive digital world, consumers have numerous options. Consumer financial institutions are under increasing pressure from competitors and alternative service providers such as credit unions, challenger banks, and other fin-tech firms. Analyzing customer data is the key to maintaining a positive customer relationship and gaining a competitive advantage. Precise data can aid in determining a customer’s behavior toward a specific service, analyzing past trends, and forecasting customer loyalty to a product or service. These data will help financial organizations develop the best marketing strategy to target the right customer while reducing unnecessary costs.

Extracting and analyzing customer data can help financial institutions better understand their customers’ needs and preferences. It will help identify potential issues or concerns, allowing them to address them quickly and effectively to maintain strong customer relationships. According to a Deloitte survey, customers perceive call centers as an important communication channel for personal banking services. For instance, when customers reach out to a call center, they expect an immediate solution rather than a round of basic questions and redirection. So, data extraction solutions can help employees access customer records quickly.

Increased operational efficiency

The financial sector is under significant pressure to thrive in the face of competition, provide the best customer service, adopt new technologies, and reduce operational costs. Most banks struggle to balance between all of these, and only a few succeed. According to a McKinsey report, most banks’ operating costs are flat on average.

To improve operational efficiency, organizations should understand where their significant investments are, what technologies are being used, what part of their organization process uses those technologies, can any functions be outsourced, and which distributional channel is profitable. Extracting relevant data to answer these questions can assist the financial sector in increasing revenue and operational efficiency.

Power innovation and outcome with the best data extraction solution

You no longer need to manually extract and manage data whenever you have a new opportunity. At Xtract.io, we offer the best data extraction solution to instantly gather structured and unstructured information from trusted sources to help you make a difference in your business. Connect with us today to unlock the power of information and transform your business.