In today’s highly competitive and data-driven landscape, retail banks are constantly seeking innovative ways to enhance customer experience, streamline operations, and boost profitability. Location intelligence is a highly impactful solution that has emerged as a game-changing force for banking and finance businesses. By harnessing the insights derived from location data, retail banks can make informed decisions that drive customer engagement, operational efficiency, and strategic growth. In this blog, we’ll delve into five ways location intelligence empowers retail banks, accompanied by real-world examples that illustrate its transformative potential.

What is location intelligence?

Location intelligence, often called spatial intelligence or geospatial intelligence, is an effective approach that harnesses the power of geographic information systems (GIS), data analytics, and visualization tools to gain valuable insights from location-based data. In retail banking, location intelligence revolves around leveraging geographical data or POI data to make informed decisions that drive business growth, enhance customer experiences, and optimize operational efficiency.

It includes gathering, studying, and analysing data linked to particular geographic points. This data can encompass various information, including demographic data, consumer behavior patterns, economic indicators, competitor locations, etc. When this data is placed on maps and viewed spatially, retail banks can reveal hidden patterns and trends that may not be easily noticeable using conventional data analysis techniques.

Branch Network Optimization

Location intelligence helps retail banks with the capability to optimize their branch network by identifying ideal locations for new branches and assessing the performance of existing ones. By analyzing factors such as population density, income levels, competitor locations, and foot traffic patterns, banks can strategically position their branches to maximize customer accessibility and engagement. For example, a bank can identify a growing suburban area lacking backing options and opt to open a new branch in this strategic location. This will increase the customer base and enhance brand presence in an underserved community.

Personalized Marketing Campaigns

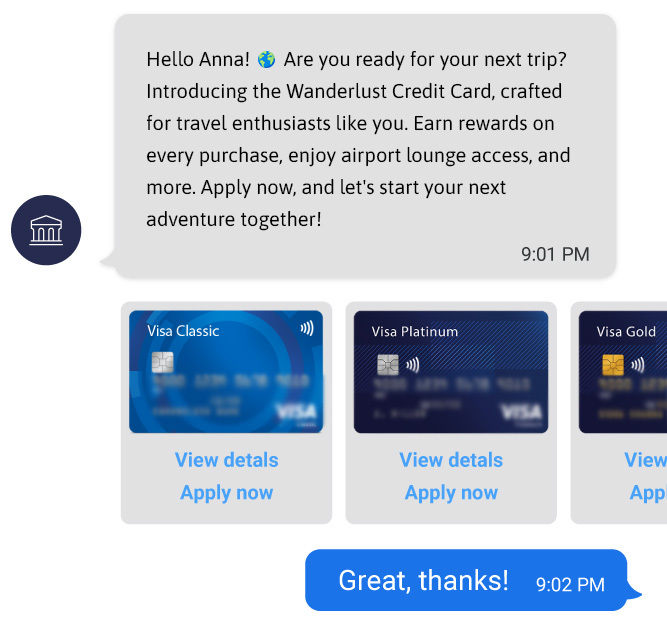

Retail banks have the ability to develop highly focused marketing campaigns that strongly connect with specific customer groups. By integrating location data with transaction histories and customer profiles, banks can deliver personalized offers and messages based on individual preferences and behaviors. For example, suppose a subset of customers frequently dine at upscale restaurants and travel internationally. In this case, the banks can identify these customers and design a targeted campaign offering travel insurance and dining rewards, resulting in a significant increase in credit card usage among the identified segment.

Risk Assessment and Fraud Prevention

Effective risk assessment is vital for retail banks to safeguard their assets and maintain customer trust. Location intelligence enhances the complexity of risk analysis by indicating patterns and irregularities that could suggest potential fraudulent activities. For example, a renowned bank leveraged location intelligence to detect unusual account activities. By analyzing location data, the bank identified instances where account logins occurred from both the customer’s hometown and a distant location within a short timeframe. This triggered an alert, and the bank’s fraud prevention team promptly contacted the customer to verify the transactions, ultimately preventing a potential breach.

Customer Experience Enhancement

Understanding the physical journey of customers allows banks to enhance the in-branch and online experiences. Location intelligence can provide insights into customer behavior, enabling banks to streamline processes, optimize service delivery, and offer tailored assistance. By tracking customer movement within the branch using beacons, the bank can identify areas of congestion and long wait times. This data-driven insight can help redesign floor layout, increase staffing during peak hours, and implement a virtual queuing system. As a result, banks can quickly reduce wait times and increase customer satisfaction.

Market Expansion and Product Launches

Location intelligence empowers retail banks to make informed decisions when expanding into new markets or launching new products. By analyzing location data, banks can identify regions with high demand for specific financial services and customize their offerings to meet local needs. For example, the bank can identify a growing demand for affordable housing by analyzing real estate trends and economic indicators in different regions. This insight can guide the bank’s decision to launch a targeted mortgage campaign in those areas, leading to a surge in mortgage applications and new customer acquisitions.

Conclusion

In the dynamic era of modern retail banking, harnessing the potential of location intelligence is no more a choice; it’s an essential strategic move. By integrating geographical context into decision-making processes, retail banks can uncover hidden insights that drive growth, enhance customer satisfaction, and streamline operations. From optimizing branch networks to delivering personalized experiences, from mitigating risks to gaining a deeper understanding of market dynamics, location intelligence emerges as a transformative tool that empowers banks to stay ahead of the curve.

For retail banks aiming to capitalize on the benefits of location intelligence, partnering with specialized solutions can expedite the process. Xtract.io, a renowned POI data provider, offers tailored solutions that cater to the unique needs of the banking and finance sector. To explore how Xtract.io can help your retail bank leverage location intelligence to its fullest potential, book a free demo.